Risk Management

Risk Management = identifying, evaluating, and addressing or defending against the impacts of risk

Managing risk is important for building and preserving your wealth. By explaining the risks in the broad range of investment products we offer, we empower you with the knowledge to make informed decisions and build strategies to provide income for your lifetime, and protect and preserve your assets for those important to you beyond.

Risks take many forms and nearly everything we do involves some form of risk. Risks to your financial future include market risks tied to your investments but also:

- Inflation risk – will your dollars buy as much in the future as they once did?

- Interest rate risk—is the interest rate you are earning on savings and bonds, keeping up with the interest rates you are paying on your mortgage, credit cards, or other debt?

- Liquidity risk—can you cover unexpected changes to your income or expenses or would you have to sell long-term investments like property?

- Longevity risk—are you earning and saving enough to provide the income you need for the rest of your life or will you outlive your money?

We look for the best defense against each potential risk.

Insuring Against Risk

Insurance is risk management through transferring or sharing the financial risk with an underwriter (insurance carrier.) Insurance contracts are unilateral agreements, meaning the insurer (insurance company) is obligated to the terms of the contract but the insured (client) can cancel the policy at any time (though there may be financial penalties.) In addition to covering your house or car against loss (property insurance) and helping pay for medical expenses (health insurance) there are many other purposes for insurance:

- providing tax-free funds to pay a mortgage or other debt, your final expenses, or to maintain quality of life for your beneficiaries when your life ends (life insurance)

- replacing your income in case of injury (disability insurance)

- affording your care in case of extended illness or inability to live independently (long-term care insurance)

- increasing retirement income during your lifetime, or for your spouse if your life ends, or mitigating inflation, tax, or interest risks (annuities or whole life insurance)

Your comprehensive Lifetime Wealth Strategies include not only plans for your life, but for those important to you beyond. Determining your insurance needs involves assessing the risks to maintaining your lifestyle now and in the future, and balancing whether feeling secure in your financial plans helps the benefits outweigh the costs of insuring against risk. The risk of over-insurance (purchasing more insurance than you need) can be avoided by maintaining communication as your life changes and periodically reviewing all of your policies, debts, assets, income and family to be sure all that is important to you is covered and policies, values, benefits, and costs are appropriate for your needs.

Reviewing your insurance with you is an important part of building security in your Lifetime Wealth Strategies.

Managing Risk

Standard asset allocation and portfolio diversification testing is designed to mitigate risk factors from the broader market environment. In addition to analyzing your complete financial picture through these lenses, we focus on what’s most important to you and customize your investments to align with your values.

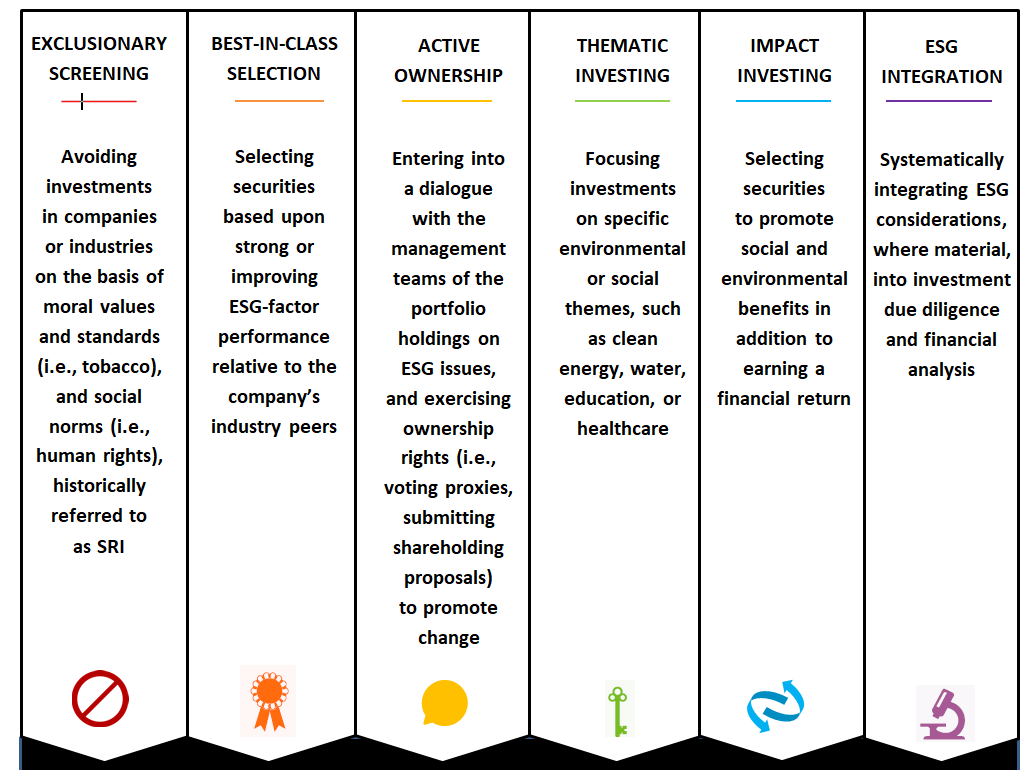

Sustainable investing focuses on investing in companies with the best long-term prospects by identifying companies which meet high standards for corporate responsibility and conscientious business practices in areas of Environmental, Social, and Governance. By incorporating ESG factor analysis when choosing investments, investors actively encourage companies to improve their ESG scores. This may result in better corporate governance, greater regulatory compliance and other positives, creating self-perpetuating benefits and a sustainable portfolio which actively avoids companies based on morals and values criteria not addressed in standard asset allocation and diversification analysis.

ESG defines a more rigorous way of evaluating companies’ standards for conducting business, including:

Environmental issues: how a company’s business practices affect natural resources, the climate, and other aspects of the environment

Social standards: a broad range of policies and the relationships that companies have with their employees, their customers, and the communities where they conduct business

Governance practices or how a company manages itself: including executive compensation, internal business controls, and the rights granted to shareholders.

Source: CFA Institute,“Environmental, Social, and Governance Issues in Investing: A Guide for Investment Professionals,”2015

POSITIVE, MATERIAL IMPACT ON PERFORMANCE

Increased awareness that ESG factors have a positive impact on performance is driving growth in ESG investment. Changing social norms, demographics, and political polarization in the country is leading investors to want to see their social views represented in their portfolios. Millennials consistently express greater desire for some sort of sustainable investing solution.

Researchers from the University of Oxford and Arabesque Partners aggregated the results of 200 studies globally and reports on the impact of sustainability on corporate performance and found the following:

- 90% of the studies conducted showed that sound sustainability standards can lower a company’s cost of capital, allowing these companies to grow with lower costs and greater potential shareholder returns.

- 88% of the research showed that solid ESG practices result in better operational performance.

- 80% of the studies showed that good ESG practices positively influence a company’s stock price.

In 2019, the Morgan Stanley Institute for Sustainable Investing published Sustainable Reality: Analyzing Risk and Returns of Sustainable Funds comparing the return and risk performance of ESG-focused mutual and exchange-traded funds against traditional counterparts from 2004 to 2018 and found that sustainable funds demonstrate lower downside risk. During a period of extreme volatility, the study found “strong statistical evidence that sustainable funds are more stable.”

Please ask us for more information about how responsible investing can help you manage risk, mitigate volatility, and align your investments with your values.

The returns on a portfolio consisting primarily of Environmental, Social and Governance ("ESG") aware investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because ESG criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Asset allocation and diversification do not guarantee profit or protect against a loss. Past performance is no guarantee of future results.