Tax Law Changes: 2026

2026 Tax Law Changes: What Investors and Families Need to Know

Each year, the Internal Revenue Service (IRS) adjusts dozens of tax rules to reflect inflation and legislative changes. For 2026, those updates include higher income thresholds, increased deductions, and expanded credits—along with several structural changes affecting households, businesses, and high-net-worth families.

Below is an overview of several of these changes, and what they could mean for your financial plan.

Updated Levels and Limits

Bracket Changes

The IRS adjusts tax brackets annually to account for inflation. For 2026, income thresholds across all brackets will rise, potentially allowing taxpayers to keep more income in lower tax brackets.

For tax year 2026, the top tax rate remains 37% for individual single taxpayers with incomes greater than $640,600 ($768,700 for married couples filing jointly). The other rates are:

35% for incomes over $256,225 ($512,450 for married couples filing jointly);

32% for incomes over $201,775 ($403,550 for married couples filing jointly);

24% for incomes over $105,700 ($211,400 for married couples filing jointly);

22% for incomes over $50,400 ($100,800 for married couples filing jointly);

12% for incomes over $12,400 ($24,800 for married couples filing jointly).

The lowest rate is 10% for incomes of single individuals with incomes of $12,400 or less ($24,800 for married couples filing jointly).

Standard Deduction Increases

The standard deduction—the amount most taxpayers subtract from income before taxes—will rise again in 2026:

- $16,100 for single filers (up from $15,750 in 2025)

- $32,200 for married couples filing jointly (up from $31,500 in 2025)

- $24,150 for heads of household (up from $23,625 in 2025)

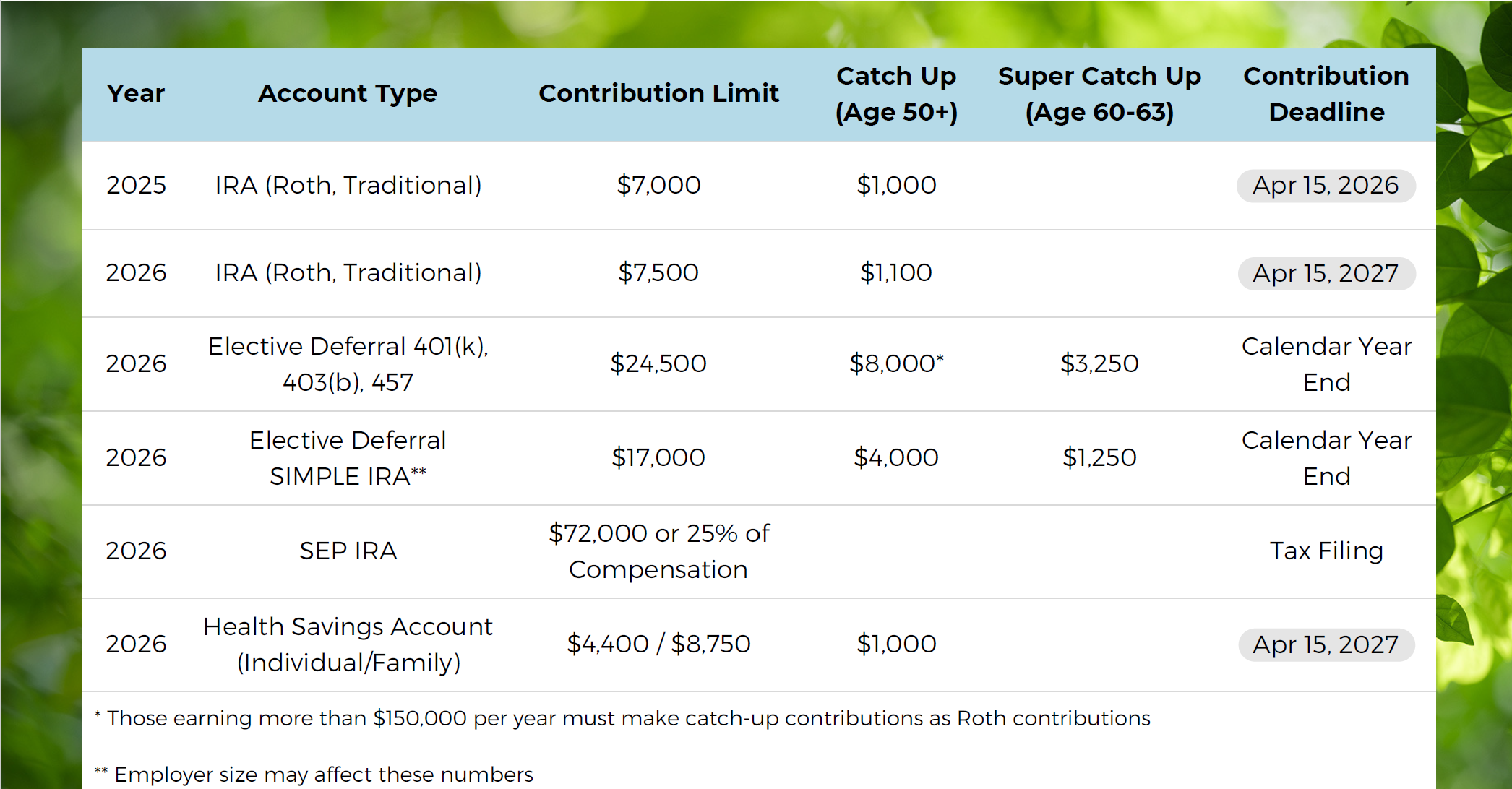

Maximum Contribution Level Changes

Updates on Deductions

Deduction for Seniors:

A new $6,000 per individual deduction ($12,000 married filing joint) was created for seniors (age 65 or over) for 2025 and is set to expire in 2028. This deduction is the answer to the no taxation on social security income. This deduction has no impact directly on social security income taxation, it was designed to help minimize the taxes paid on social security income. This deduction is allowed even if you itemize or take the standard deduction. It is subject to an income phase out starting at $75,000 or single and $150,000 for married filing joint.

Auto Loan Interest Deduction:

A new deduction has been created to deduct interest paid on certain automobile loans starting in 2025. The deduction is a pre-AGI deduction, is capped at $10,000, and is allowed for tax years 2025-2028. This deduction is subject to a phase out starting at $100,000 for singles and $200,000 for married filing joint. The car purchase must follow certain criteria.

Charitable Deductions:

A charitable deduction of $1,000 for singles and $2,000 for married filing joint filers has been made available, on top of the standard deduction. This means you don’t have to itemize, or give more than the standard deduction in order to receive some tax benefit from your charitable donations.

The OBBA limited deductions for the top tax rates. Those in the top tax bracket will now have a limit on how much of their gift they can deduct on their taxes—instead of 37 cents on the dollar, the maximum is 35 cents for every dollar for the 2026 tax year.

The OBBA also created a floor of .5% of charitable deductions, so the AGI x .005 is taken off the table and not included as a deduction. Another reason to potentially give sooner.

Tip Pay Deduction:

A new deduction was created to allow those who received tip income to deduct a substantial portion of the tips reported on their W-2. This deduction starts in 2025 and ends in 2028 and allows a tipped employee to deduct as a pre-AGI adjustment up to $25,000 per taxpayer in tips.

Overtime Pay Deduction:

A new deduction was created to allow for a deduction of overtime pay. This deduction starts in 2025 and ends in 2028. The deduction is a pre-AGI adjustment up to $12,500 for singles and $25,000 for married filing jointly.

IRS has defined the qualified overtime compensation as the pay that exceeds their regular rate of pay – such as the “half” portion of “time-and-a-half” compensation—that is required by the Fair Labor Standards Act.

State and Local Tax Deduction:

Prior to 2025, one could deduct the state income tax, local income tax, real estate taxes, and excise taxes with a limit of $10,000. With such a high standard deduction, this deduction was rarely beneficial. Now that deduction has been raised to $40,000 starting in 2025. While our state and local taxes are low relative to the rest of the country, Indiana does allow for a deduction for those taxes paid.

Final Thought: Tax Planning Is Ongoing, Not Seasonal

IRS changes for 2026 highlight an important reality: tax planning is not just about filing returns—it’s about aligning financial decisions with evolving rules.

As tax laws continue to shift, reviewing your portfolio, income strategy, and estate plan can help ensure you’re positioned to take advantage of opportunities while managing risk.

If you have questions about how the 2026 tax changes may affect your financial plan, let's chat.

As always, we are not tax professionals, but we are happy to connect you with some great ones, or work with yours. Please refer to your tax professional for advice surrounding your situation.