Weekly Market Commentary | October 31, 2022

Some companies are doing better than others – a lot better.

It’s earnings season; the time when companies share how well they performed during the previous quarter. Earnings reports are important because they provide information about a company’s financial health. Shareholders pay particular attention to earnings, which are company profits after expenses have been subtracted.

At the end of last week, slightly more than half of the companies in the Standard & Poor’s (S&P) 500 Index had reported results for the third quarter of 2022. The blended earnings growth rate* for the S&P 500 was 4.1 percent, year-over-year, according to I/B/E/S data from Refinitiv.

The worst performing sector was communication services, which includes some big technology names. Earnings for the sector were down 20.9 percent for the third quarter. At the other end of the spectrum was the energy sector with year-over-year earnings growth of about 136 percent. The sector was led by big oil companies, some of which posted record profits, reported Sabrina Valle and Ron Bousso of Reuters.

The weaker performance of technology companies helps explain why the Dow Jones Industrial Average (Dow), an index that includes some of the nation’s large blue-chip companies, has outperformed the Nasdaq Composite Index, which reflects the performance of the technology sector, recently, reported Ben Levisohn of Barron’s.

“And what a four weeks it has been. The Dow has jumped 14.4% in October and is on pace for its best month since January 1976, when the blue-chip benchmark surged 14.41%. The other indexes have fallen short of those gains: The Russell 2000…has climbed 11%, the S&P 500 has gained 8.8%, and the Nasdaq Composite has risen a paltry 5%.”

Investors were also encouraged by last week’s economic data. The Personal Consumption Expenditure Price Index (PCE), which is the Federal Reserve’s favored measure of inflation, “…increased 4.2 percent [in the third quarter], compared with an increase of 7.3 percent [in the second quarter]. Excluding food and energy prices, the PCE price index increased 4.5 percent [in the third quarter], compared with an increase of 4.7 percent [in the second quarter].

Investors hope evidence that price increases are not accelerating will cause the Fed to reevaluate the pace of rate hikes, reported Jacob Sonenshine and Jack Denton of Barron’s.

While recent stock market gains have been a respite for investors, corporate earnings are not as strong as the top line numbers suggest. When the energy sector is excluded, the blended corporate earnings rate was down 3.5 percent for the third quarter.

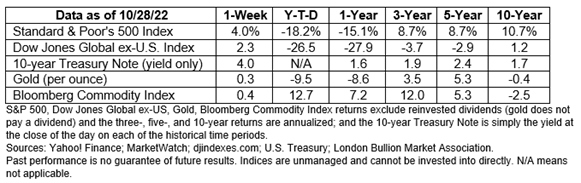

Last week, major U.S. stock indices rose, and yields for many maturities of U.S. Treasury moved lower.

*The blended rate combines actual earnings/profits for companies that have reported with consensus estimates for companies that haven’t yet reported.

WHAT DO YOU KNOW ABOUT ECONOMICS? Adam Smith defined economics as “an inquiry into the nature and causes of the wealth of nations.” Alfred Marshall offered an alternative option: Economics is the study of humans “in the ordinary business of life.” No matter how you define it, economics shapes and influences our lives. Test your knowledge of all things economic by taking this brief quiz.

1. The first version of the board game Monopoly was created to help people understand the:

a. Harm done by monopolies

b. Advantages of monopolies

c. How family members think and collaborate

d. None of the above

2. What is the paradox of thrift?

a. Saving more can lead to economic growth

b. Shoppers can find valuable items in thrift stores

c. Saving more can lead to economic slowdown

d. Spending less today could mean having more in retirement

3. Which of the following is not thought to cause prices to increase?

a. The Fed raising rates

b. Consumer spending

c. Demand for goods increasing

d. People thinking prices will move higher

4. Generally, macroeconomics considers the role of governments in a market economy.

What historical event led to the study of macroeconomics?

a. The Credit Crisis of 1772

b. World War II

c. The Great Depression

d. The Oil Crisis of 1973

The answers can be found below.

Weekly Focus – Think About It

“Economics is extremely useful as a form of employment for economists.”

—John Kenneth Galbraith, economist

Answers:

1) a. Originally called “The Landlord’s Game”, Monopoly was created by Elizabeth Magie to demonstrate what she considered to be the destructive effect of monopolies.

2) c. While saving is good for the individual, it can be detrimental to a nation’s economy. When people save more and spend less, national economic growth tends to slow.

3) a. The Fed raises rates to reduce demand, which can help bring prices down, lowering inflation.

4) c. The Great Depression led to the study of macroeconomics.

Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through IFP Securities, LLC, dba Independent Financial Partners (IFP), member FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Advisor. IFP and LIFETIME WEALTH STRATEGIES, LLC are not affiliated.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.investopedia.com/ask/answers/070615/what-difference-between-earnings-and-profit.asp

https://lipperalpha.refinitiv.com/wp-content/uploads/2022/10/TRPR_82201_20221028.pdf

https://www.barrons.com/articles/stock-market-dow-nasdaq-dot-com-bubble-51667004324?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-31-22_Barrons_Shades%20of%20the%20Dot%20Com%20Bust_4.pdf)

https://www.bea.gov/sites/default/files/2022-10/gdp3q22_adv.pdf [See Table 4]

https://www.barrons.com/livecoverage/stock-market-today-102822/card/stocks-drop-after-brutal-week-for-big-tech-earnings-BpI0odeClhgz6Ovfw41T (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-31_22_Barrons_Stocks%20Rallied%20After%20a%20Brutal%20Week%20for%20Tech%20Earnings_6.pdf)

https://www.bloomberg.com/markets/stocks

https://corporatefinanceinstitute.com/resources/knowledge/economics/what-is-economics/

https://www.brainyquote.com/quotes/john_kenneth_galbraith_105472?src=t_economics

https://www.atlantafed.org/economy-matters/quiz/2018/0621-terms-and-conditions (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-31-22_Federal%20Reserve%20Bank%20of%20Atlanta_11.pdf)

https://www.thebalancemoney.com/causes-of-inflation-3-real-reasons-for-rising-prices-3306094

https://www.jstor.org/stable/2077848

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not