Weekly Market Commentary | October 17, 2022

We’re not there yet.

Investors are understandably eager for the stock market to hit bottom. Some hoped it happened last week, but it did not.

Despite the Fed’s rate hikes, last week the Consumer Price Index showed the annual rate for headline inflation was 8.2 percent in September. That’s down from June when the annual inflation rate was 9.1%, but a long way from the Federal Reserve’s two percent target. The core inflation numbers, which exclude food and energy, hit at a 40-year high last month.

The news rocked the markets. “A lot of investors are looking at inflation to get guidance on what the Fed is going to do, to find the bottom in the market once the Fed pivots…But looking at CPI, unemployment, there’s obviously a lot of heat in the economy. Inflation is going to take some time to come down,” said a source cited by Stephen Kirkland and Lu Wang of Bloomberg.

After the news broke on Thursday, the Standard & Poor’s (S&P) 500 Index fell 2.4 percent. The sharp drop made some investors wonder whether the bear market had finally bottomed. The Index reversed course and finished the day up 2.6 percent, reported Ben Levisohn of Barron’s. That’s a big swing.

Then, on Friday, the University of Michigan’s Consumer Sentiment Survey was released. The good news was consumers were feeling slightly more optimistic in September. The bad news was expectations for inflation over the coming year rose slightly. Survey participants anticipated inflation would average 2.9% over the year ahead.

Inflation expectations are important because inflation has a psychological component. If people expect inflation to be higher – and behave that way – then they could cause inflation to move higher. For example, if a company expects higher inflation, it may increase prices at a faster rate than it would otherwise. If workers expect inflation to move higher, they may ask for larger wage increases than they would otherwise. These types of actions push inflation higher.

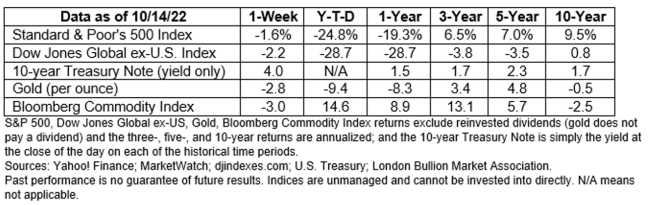

The S&P 500 headed down again on Friday and finished the week lower. The Nasdaq Composite Index also finished down, but the Dow Jones Industrial Index moved higher as some of the companies in the Index reported solid earnings. Treasury rates rose last week, with the 2-year Treasury yielding 4.48 percent and the 30-year Treasury yielding 3.99 percent.

FOOD FOR THOUGHT…When markets are volatile, it is difficult to be an investor. Headlines shout about losses. Quarterly statements show a significant drop in the value of savings and investments. It becomes all too easy to focus on short-term market movements and lose sight of long-term financial goals.

When market volatility produces anxiety, it may help to consider the words of people who have spent decades investing successfully through bull and bear markets.

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

—Charlie Munger, Warren Buffett’s right-hand

“Investing isn't a game to be won. At the end of the day, it's a way to achieve your big goals, like buying that home, starting that business, and retiring on your own terms.”

—Sallie Krawcheck, investment company CEO

“The stock market is a giant distraction from the business of investing.”

—John C. Bogle, the father of index funds

“The most important thing is to stay the course – not to get shaken out of the market during a difficult time.”

—John W. Rogers, Jr., investment company Chair and CEO

“Never is there a better time to buy a stock than when a basically sound company, for whatever reason, temporarily falls out of favor with the investment community. When bad things happen to good companies, it must be viewed as a buying opportunity rather than a bailout,”

—Geraldine Weiss, the blue chip stock guru

If recent market activity has left you questioning whether investing is a good idea, please get in touch. We’re happy to listen and discuss your experience, concerns, and financial goals.

Weekly Focus – Think About It

“Our latest survey finds 40% of money managers bullish about the outlook for stocks over the next 12 months, and 30% bearish. The bullish cohort has increased from 33% since the spring edition of the poll, which found a plurality of managers neutral, but the bearish contingent has also grown from 22%...In interviews, many Big Money managers sound more bullish than survey results suggest. Markets might stay volatile and challenging for the next year, but opportunities abound to scoop up quality stocks at cheap valuations. For investors whose time horizon extends well beyond a year, the current environment looks to be a gift.”

—Barron’s Big Money Poll, October 13, 2022

Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through IFP Securities, LLC, dba Independent Financial Partners (IFP), member FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Advisor. IFP and LIFETIME WEALTH STRATEGIES, LLC are not affiliated.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.barrons.com/articles/stock-market-dow-nasdaq-sp500-51665789304?mod=hp_LEAD_2&noredirect=y (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-17-22_Barrons_The%20Stock%20Markets%20Rebound%20Fizzled%20Again_3.pdf)

https://www.bloomberg.com/news/articles/2022-10-13/asia-stocks-set-to-join-wild-ride-higher-after-cpi-markets-wrap?srnd=markets-vp (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-17-22_Bloomberg_Stocks%20Upended%20by%20Inflation%20Surveys%20Sobering%20View_4.pdf)

https://twitter.com/charliemunger00/status/1526174877694185474

https://www.brainyquote.com/quotes/sallie_krawcheck_899560

https://www.brainyquote.com/quotes/john_c_bogle_1119994

https://www.brainyquote.com/authors/john-w-rogers-jr-quotes

https://www.barrons.com/articles/stock-market-inflation-fed-interest-rates-51665776799?mod=hp_columnists&noredirect=y (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-17-22_Barrons_Its%20Time%20for%20Bargain%20Hunting_13.pdf

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.