Weekly Market Commentary | June 20, 2022

The fight against inflation intensified.

Last week, the Federal Reserve (Fed) delivered a message that it is serious about fighting inflation. The Federal Open Market Committee (FOMC) lifted the federal funds target rate by 0.75 percentage points. The fed funds rate is now 1.50 percent to 1.75 percent.

The Fed also has begun to shrink its $9 trillion balance sheet by selling Treasury securities and agency mortgage-backed securities, a process known as quantitative tightening (QT), reported Kate Duguid, Colby Smith, and Tommy Stubbington of Financial Times (FT). The Fed’s balance sheet expanded greatly during the past few years as it engaged in quantitative easing (QE). QE entailed buying Treasury and agency securities to ease financial conditions, strengthen the economy, and support markets during the pandemic.

If QT was a rate hike, it would be “roughly equivalent to raising the policy rate a little more than 50 basis points on a sustained basis,” according to a paper published by the Fed in June. Although, the authors stated there was considerable uncertainty associated with the estimate. It’s hard to be certain about what will happen when the Fed has only attempted QT once before.

Global markets weren’t enthusiastic about the fact that the Fed and other central banks are tightening monetary policy. Harriet Clarfelt and colleagues at FT reported, “US stocks have suffered their heaviest weekly fall since the outbreak of the coronavirus pandemic, after investors were spooked by a series of interest rate increases by big central banks and the threat of an ensuing economic slowdown.”

It’s likely that markets will continue to be volatile, according to the CBOE Volatility (VIX) Index®, which measures expectations for volatility over the next 30 days. The VIX is known as Wall Street’s fear gauge. Last week, it rose to 31. That’s well above its long-term average of 20.

Last week, major U.S. stock indices tumbled, and yields moved higher across much of the

Treasury yield curve.

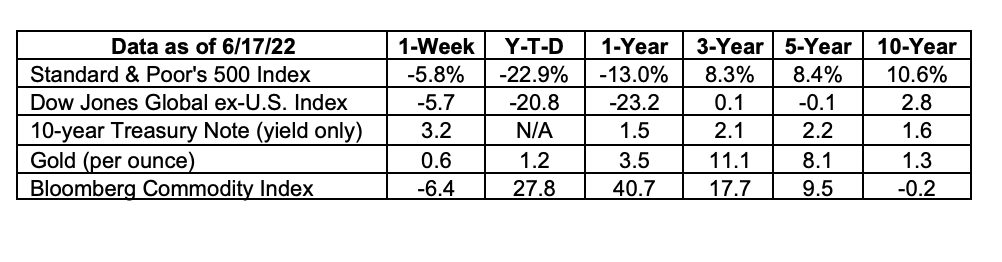

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

IS THE BOND MARKET OR THE STOCK MARKET A BETTER RECESSION PREDICTOR? The stock market has been dropping, but that doesn’t necessarily mean a recession is ahead. The stock market isn’t very accurate when it comes to predicting recessions.

In 1966, following two decades of almost uninterrupted economic growth and stock market gains, a bear market arrived. Stock investors feared a recession might be ahead, and the S&P 500 Index dropped 24 percent over eight months before rebounding and moving higher.

Economist Paul Samuelson, the first person to win a Nobel prize in economics, quipped, “The stock market has predicted nine out of the last five recessions. A factcheck of Samuelson’s off-the-cuff remark in 2016 found that he was right. Bear markets in stocks lead to recessions about 53 percent of the time, reported Steven Liesman of CNBC.

In other words, the stock market has about the same predictive value for recessions as a coin toss. The Treasury bond market has a far better record.

In normal circumstances, yields on Treasuries rise as maturities get longer. So, a two-year Treasury bill will normally yield less than a 10-year Treasury note. On occasion, shorter-maturity Treasuries yield more than longer-maturity Treasuries. This is unusual because investors usually want to earn more when they lend money for a longer period of time. When two-year Treasuries yield more than 10-year Treasuries, we have an inverted yield curve. (The name, “yield curve,” describes how the data looks on a chart.)

An inverted yield curve is a more reliable indicator that a recession is ahead. Alexandra Skaggs of Barron’s explained, “In a recent study of yield curve inversions, BCA Research found that the gap between 2- and 10-year yields has inverted before seven of the past eight recessions...The gap between 3-month and 10-year yields has a better record, calling all 8 recessions without a false signal.”

At the end of last week, the yield curve was not inverted. Three-month and two-year Treasuries were yielding 1.63 percent and 3.17 percent, respectively. The 10-year Treasury was yielding 3.25 percent.

Weekly Focus – Think About It

“My interest is in the future because I am going to spend the rest of my life there."

—Charles Kettering, engineer and inventor

Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through IFP Securities, LLC, dba Independent Financial Partners (IFP), member FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Advisor. IFP and LIFETIME WEALTH STRATEGIES, LLC are not affiliated.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20220615a.htm

https://www.ft.com/content/2496105a-d211-4abe-ab5d-46a91876428f (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-20-22_Financial%20Times_Fed%20Begins%20Quantative%20Tightening_2.pdf)

https://www.ft.com/content/80d79903-415b-4c8e-8715-2eeb86e09300

https://www.cboe.com/tradable_products/vix/

https://www.ft.com/content/eb643be2-a3c9-49f9-815b-795449ccea44 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-20-22_Financial%20Times_Rising%20Rates%20Big%20Losses_6.pdf)

https://www.barrons.com/articles/stock-market-dow-nasdaq-sp500-51655511568?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-20-22_Barrons_The%20Stock%20Market%20Had%20a%20Very%20Bad%20Week_7.pdf)

https://stockinvesting.today/ma1607/article/the-1966-bear-market?

https://www.cnbc.com/2016/02/04/can-the-markets-predict-recessions-what-we-found-out.html

https://www.investopedia.com/terms/i/invertedyieldcurve.asp

https://www.barrons.com/articles/inverted-yield-curve-recession-wall-street-51649170366?tesla=y (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-20-22_Barrons_An%20Inverted%20Yield%20Curve%20Doesnt%20Always%20Predict%20a%20Recession_12.pdf)

https://www.brainyquote.com/quotes/charles_kettering_163122

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.