Weekly Market Commentary | August 22, 2022

Is this a bear market rally or a new bull market?

Investment professionals are in the middle of a heated debate. Since mid-June, United States stock markets have moved higher, regaining about $7 trillion as many investors who had sold shares during the first half of the year began buying again, reported Lu Wang of Bloomberg. The debate is about whether the stock market is in the midst of a bear market rally or a new bull market.

A bull market occurs when share prices rise steadily over time. In a recent Morning Briefing on LinkedIn, Edward Yardeni of Yardeni Research, explained the debate:

“From a fundamental perspective, the bears expect that inflation will remain elevated, forcing the Fed to raise interest rates much higher, causing a severe recession. The bulls, like us, believe that inflation might have peaked in June and that the Fed is likely to pause for a while following one more rate hike of [0.50 to 0.75 percent] in late September. The bears see lots more downside for earnings and valuation multiples. We see flattening corporate earnings through the end of this year and believe that forward valuation multiples bottomed on June 16. In our bullish narrative, the market could move sideways for a while before moving to new record highs next year.”

Will Daniel of Fortune reported, “Morgan Stanley has repeatedly argued that the recent stock market rally is nothing but a bear market trap, while Bank of America has warned that stocks have more room to fall based on historical trends.”

In an effort to determine whether it is possible to distinguish bull markets from bear market rallies, one Minnesota research group examined data going back 65 years, reported Bloomberg. “The answer is that it remains next to impossible to say in real time which ones will last. Methods people claim work often fall apart when looked at rigorously.”

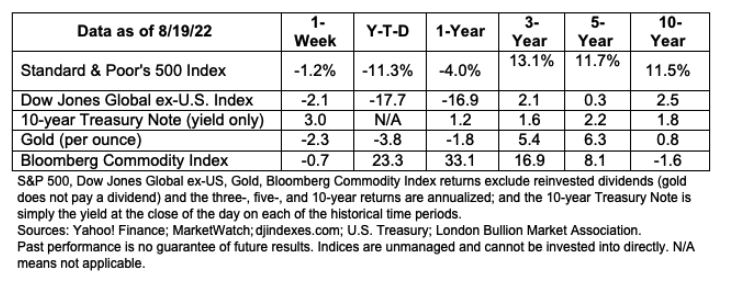

Last week, a pause in the rally added fuel to the debate. The Standard & Poor’s 500 Index declined after four weeks of gains, reported Ben Levisohn of Barron’s. U.S. Treasury yields moved higher as investors parsed Federal Reserve commentary, reported Samantha Subin and Natasha Turak of CNBC.

TAX BREAKS AND REBATES…The Inflation Reduction Act of 2022, which was recently signed into law, offers some financial incentives for households and businesses that are ready to begin transitioning to cleaner energy. Here are a few of the key tax breaks and rebates for individuals.

-

$7,500 tax credit for a new electric vehicle (EV). Anyone who purchases an electric, plug-in hybrid, or hydrogen fuel cell vehicle between now and 2032 may qualify for up to $7,500 in tax credits. Americans who purchase used EVs may qualify to receive up to $4,000 in tax credits or 30 percent of the sale price, whichever is less, reported Greg Iacurci of CNBC. Next year, car buyers will be able to choose whether to take the tax credit as a discount at the point of purchase, reported Kelley R. Taylor of Kiplinger.

These credits could give the EV market a boost if consumers who were deterred by the higher cost of electric vehicles, reconsider the option. Consumer Reports recently found that “the latest generation of mainstream EVs typically cost less to own than similar gas-powered vehicles, a new development in the automotive marketplace with serious potential consumer benefits.”

-

Tax credit for solar panels and other renewable energy sources. There is also a tax credit available for consumers who install solar panels or other equipment designed to capture and store renewable energy from wind, geothermal, and biomass fuel, reported CNBC. The credit extends and enhances an existing program. Under the current rules, homeowners who complete clean energy projects may qualify for a tax credit of up to 30 percent of the cost if the project is done before 2032. The credit falls to 26 percent in 2033, and 22 percent in 2034.

-

$2,000 annual tax credit for improving home energy efficiency. From 2022 through 2032, homeowners may receive a tax credit for installing energy-efficient windows, skylights, water heaters, and doors, as well as electric or natural gas heat pumps, and biomass stoves or boilers.

The legislation also includes rebate programs, which will be administered by state governments, for consumers who cut home energy use by at least 20 percent.

Weekly Focus – Think About It

“I always want to say to people who want to be rich and famous: try being rich first. See if that doesn't cover most of it. There's not much downside to being rich, other than paying taxes and having your relatives ask you for money. But when you become famous, you end up with a 24-hour job.

—Bill Murray, actor

Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through IFP Securities, LLC, dba Independent Financial Partners (IFP), member FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Advisor. IFP and LIFETIME WEALTH STRATEGIES, LLC are not affiliated.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bloomberg.com/news/articles/2022-08-18/a-2-trillion-options-deadline-is-make-or-break-moment-for-bulls (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-22-22_Bloomberg_A%202%20Trillion%20Stock%20Options%20Deadline%20is%20Make-or-Break%20Moment%20for%20Bulls_1.pdf)

https://www.linkedin.com/pulse/young-bull-old-bear-edward-yardeni/https://finance.yahoo.com/quote/%5EGSPC?p=%5EGSPC (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-22-22_LinkedIn%20Aug%2017%20Morning%20Briefing_2.pdf)

https://fortune.com/2022/08/17/is-stock-bear-market-rally-real-dead-cat-bounce-ubs-volatility-recession/

https://www.bloomberg.com/news/articles/2022-08-17/how-to-tell-a-new-bull-from-a-bear-market-fakeout-toss-a-coin (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-22-22_Bloomberg_How%20to%20Tell%20a%20New%20Bull%20from%20a%20Bear%20Market%20Fakeout_4.pdf)

https://www.barrons.com/articles/stock-market-recession-economy-federal-reserve-51660955167?mod=hp_LEAD_1 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-22-22_Barrons_The%20Stock%20Market%20Couldnt%20Handle%20the%20Uncertainty_5.pdf)

https://www.cnbc.com/2022/08/19/treasury-yields-move-higher-following-jobless-claims-report.html

https://www.cnbc.com/2022/08/13/how-to-qualify-for-inflation-reduction-act-climate-tax-breaks-rebates.html

https://www.kiplinger.com/taxes/605016/inflation-reduction-act-and-taxes

https://advocacy.consumerreports.org/wp-content/uploads/2020/10/EV-Ownership-Cost-Final-Report-1.pdf [Page 3]

https://www.brainyquote.com/quotes/bill_murray_411631?src=t_taxes

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.